2024 Irs Schedule 4972 – The IRS must hold those refunds until mid-February by law, meaning they won’t hit taxpayers’ bank accounts until around Feb. 27, according to the IRS. Here’s how to make sure you get your . Taxpayers can start filing their taxes for the 2022 tax year on January 23, 2023. You can use the schedule chart below to estimate when you can expect to receive your refund based on when you .

2024 Irs Schedule 4972

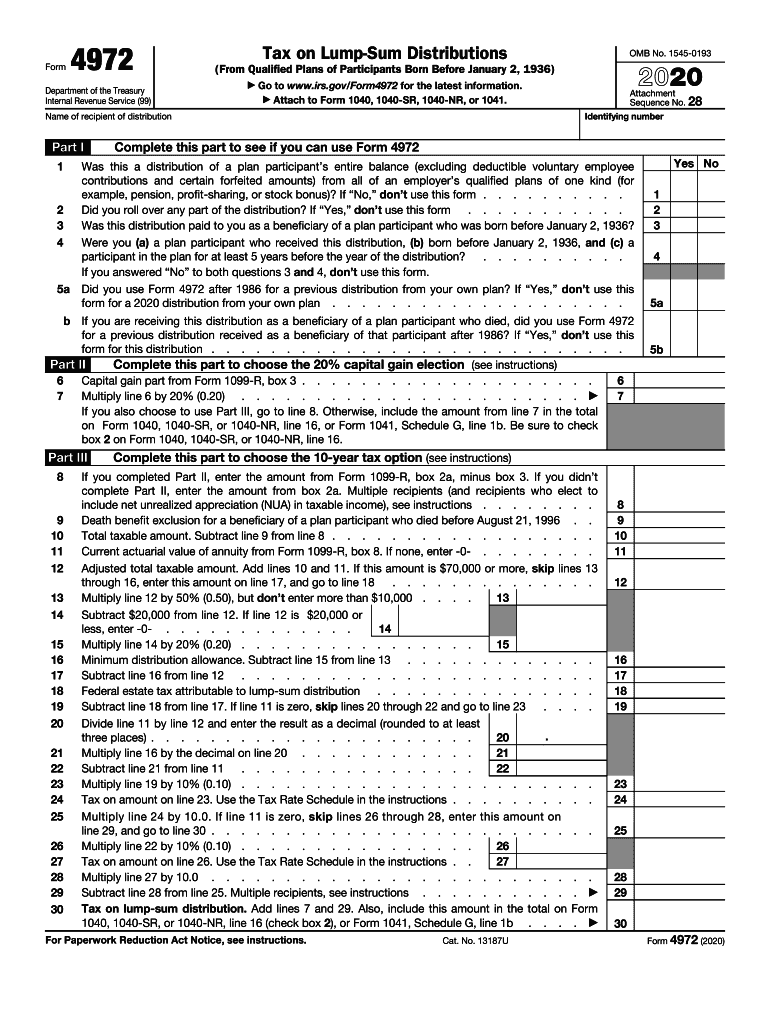

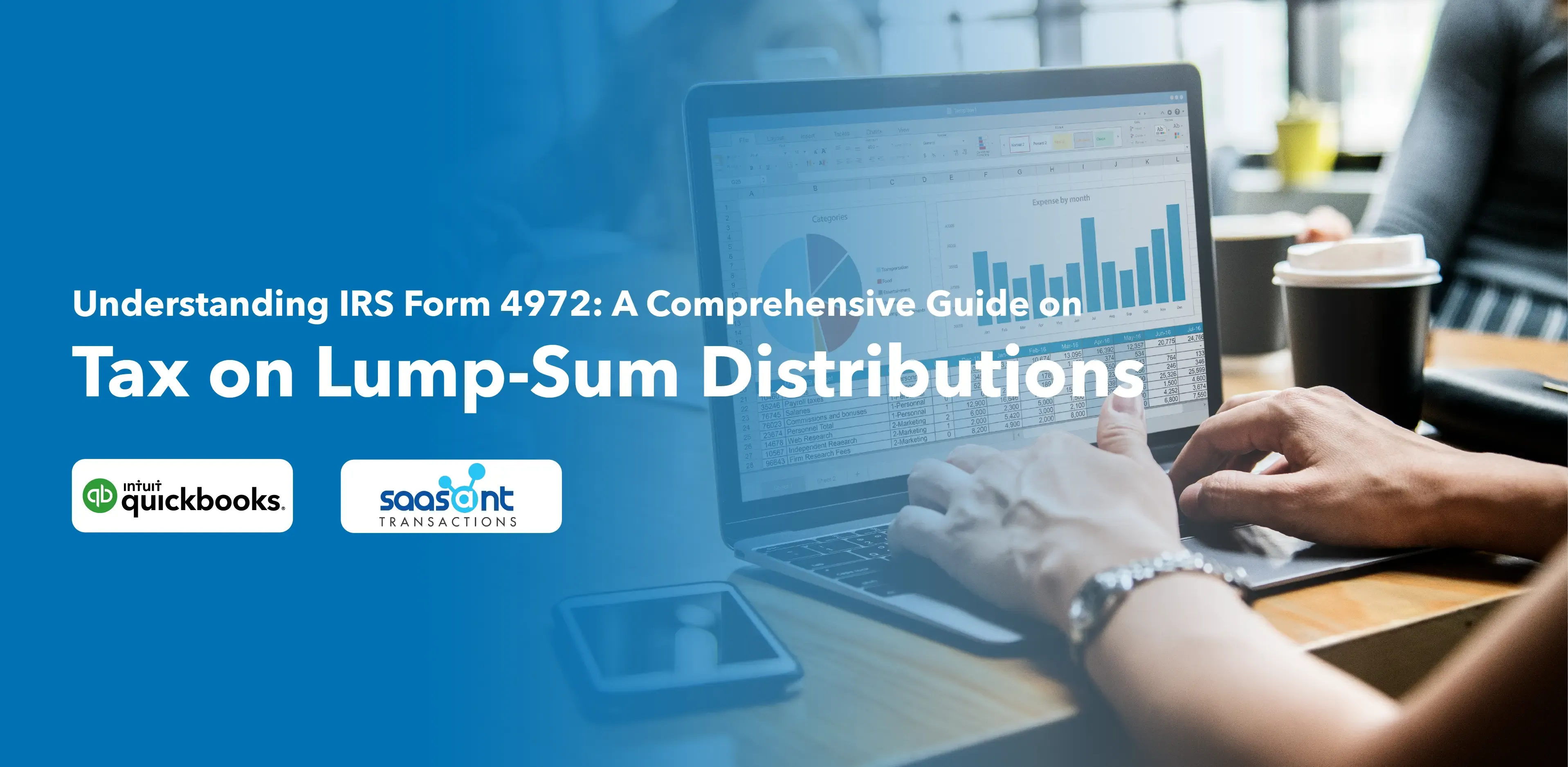

Source : www.dochub.comUnderstanding IRS Form 4972: A Comprehensive Guide on Tax on Lump

Source : www.saasant.com2023 Form IRS 4972 Fill Online, Printable, Fillable, Blank pdfFiller

Source : form-4972.pdffiller.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov2022 2024 Form IRS 5330 Fill Online, Printable, Fillable, Blank

Source : form-5330.pdffiller.comForm 1040 V: Payment Voucher Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comIRS gives standard deductions an inflation boost for 2023 tax

Source : katu.comSchedule A (Form 1040) Guide 2024 | US Expat Tax Service

Source : www.taxesforexpats.comIRS 4972 form | pdfFiller

Source : www.pdffiller.comFact Check Team: Several states cut income taxes to help Americans

Source : wwmt.com2024 Irs Schedule 4972 Form 4972: Fill out & sign online | DocHub: Important Dates and Deadlines for Tax Season 2023 The following is a schedule of the most important days and events of this year’s tax season, but you’ll want to pay special attention starting . If you are a sole proprietor, you report your business profit or loss on Internal Revenue Service Schedule C of Form 1040, Profit or Loss From Business. If you sell merchandise or manufacture a .

]]>